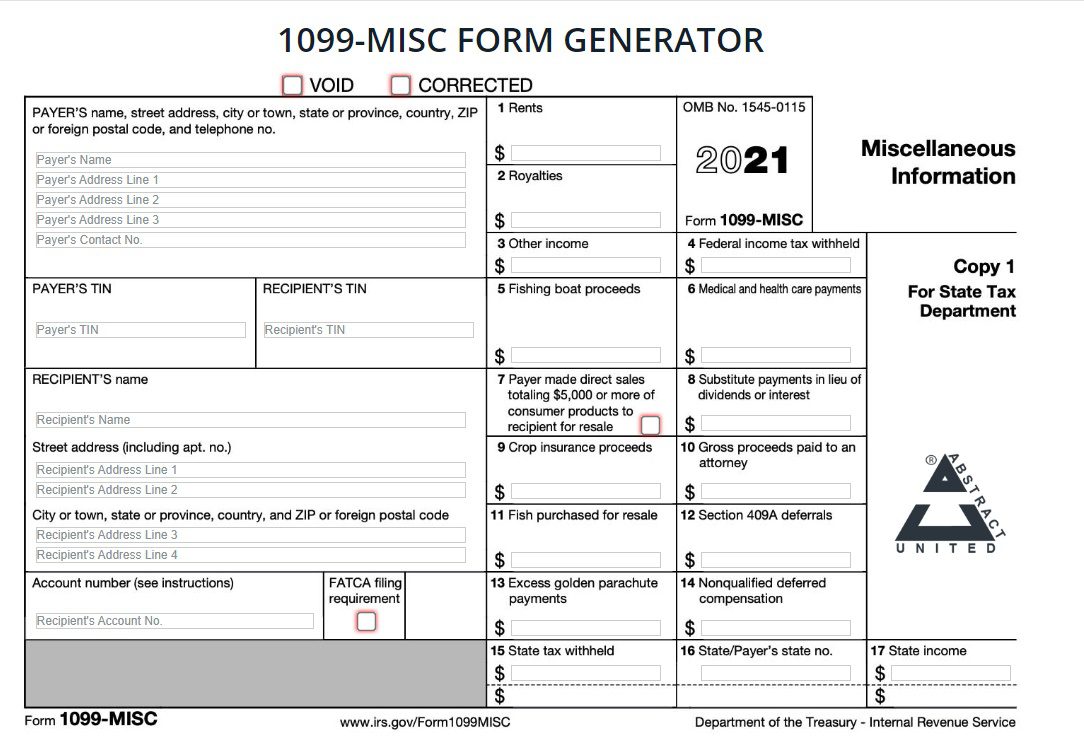

JORDANOVWRESTLING.COM | Printable 1099 Forms Free Download - IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types

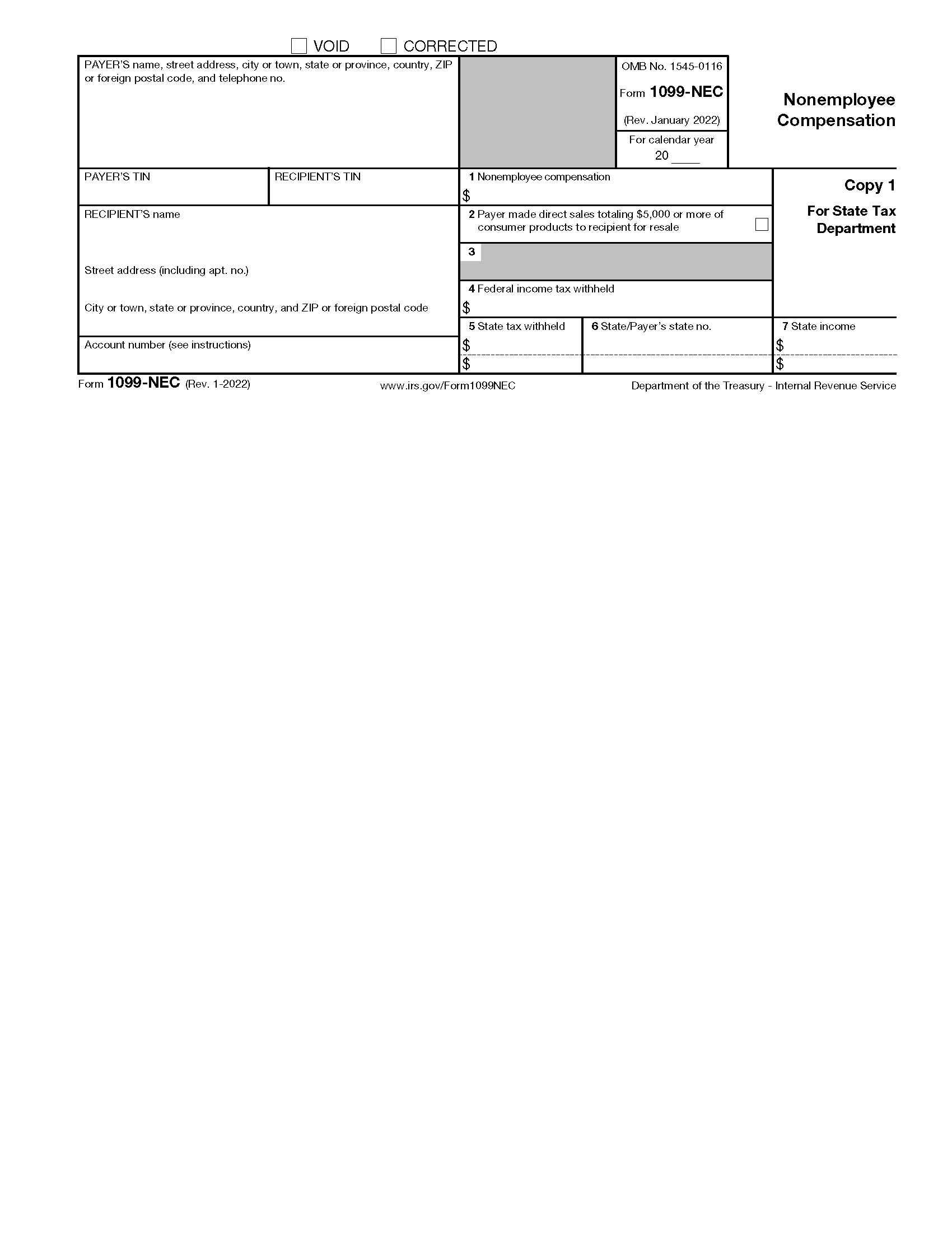

Free IRS 1099 Form PDF eForms, A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes . Form 1099 MISC Free Template Dropbox Sign, Similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not Do not print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS information return forms that can t be scanned .

Printable 1099 Forms Free Download

Form 1099 MISC Free Template Dropbox Sign

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types .

Free IRS 1099 NEC Form 2021 2024 PDF eForms

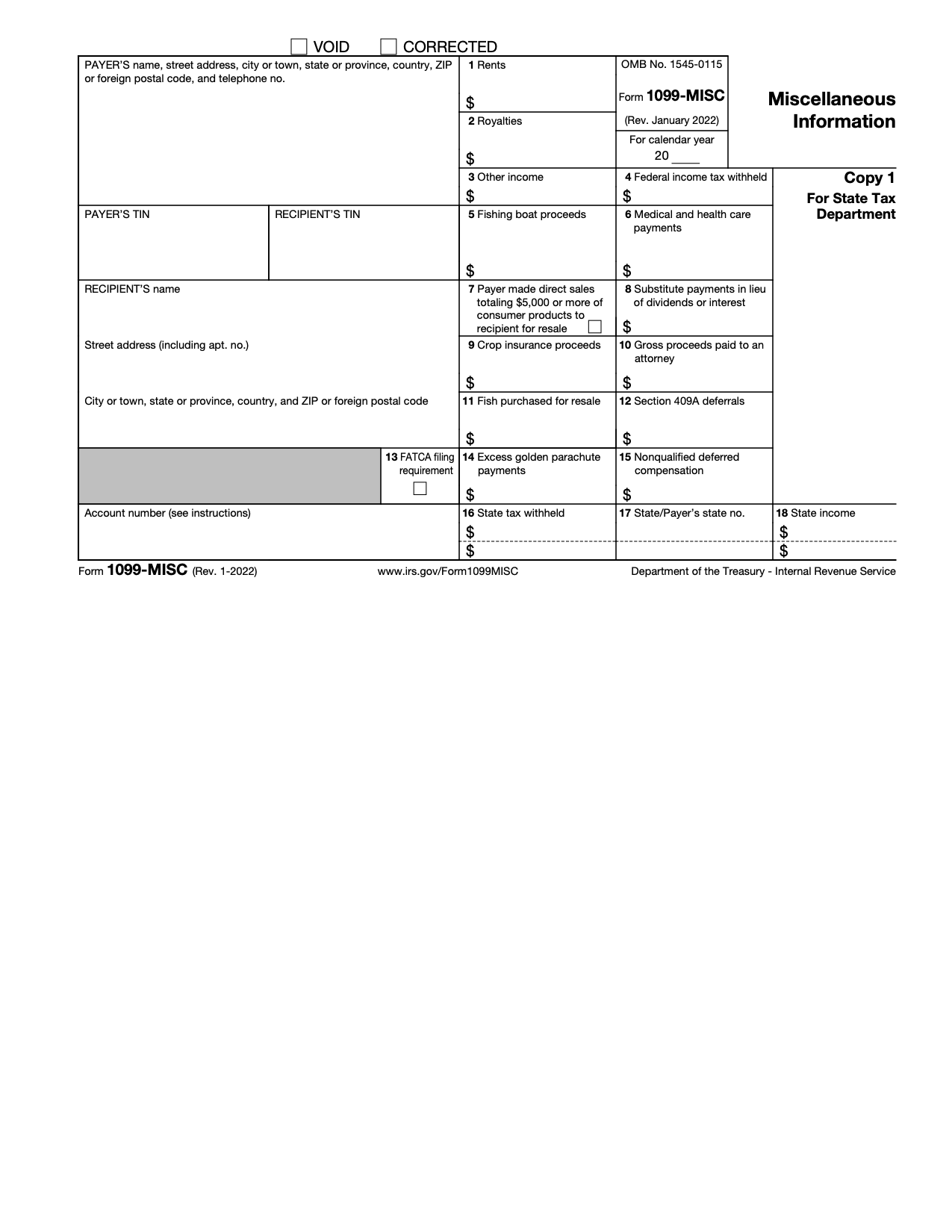

Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS which is located at www irs gov Download and Print a 1099 MISC Form 2024 For filling out taxes on income earned from 1 1 2024 to 12 31 2024 DOWNLOAD PDF Fill Out Form .

2024 IRS Form 1099 MISC Fill Out Save With Our PDF Editor

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately .

2024 1099 MISC Form Fillable Printable Download 2024 Instructions

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes .

Free IRS Form 1099 MISC PDF eForms

2024 IRS Form 1099 MISC Businesses depend on Form 1099 MISC to stay on top of reporting payments to non employees If your company pays someone 600 or more in miscellaneous income think rent prizes or other other types of income you must send them a 1099 MISC by January 31 .

span class result type PDF span Form 1099 NEC Rev January 2024 Internal Revenue Service

An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS .

Disclaimer: Materials available on this site are from various creators. If you are a copyright holder and wish to have your content removed or credited properly, kindly contact us.

![]()

Top Questions You May Have

1. Can I print items for free?

Free printables are files available for free download and printing, such as activity sheets, coloring pages, and more!

2. Can I find a variety of printables?

Our printables include everything from study planners, art projects, to craft templates.

3. How do I download a printable?

Click the image or link to open the printable, and save it to your computer with a right-click. It’s free and easy!

4. Are these printables high resolution?

We offer high-resolution files in PNG or JPG format, perfect for printing with excellent clarity.

5. Are the printables for commercial use?

Commercial use of the printables is not allowed without permission from the creator. Please refer to the licensing terms on the original site.