JORDANOVWRESTLING.COM | Free Printable Schedule C Tax Form - File your Schedule C with the IRS for free Report self employment income and expenses E File schedules for form 1040 and form 1040 SR using FreeTaxUSA All Years 2017 2023 File 2023 Tax Return File 2022 Tax Return File 2021 Tax Return View My Prior Year Return s After You File

How to E File a Schedule C Form on FreeTaxUSA , The Best Way to reduce you taxable income is Track Income Expenses for Tax Form 1040 Schedule C I would love for you the taxpayer to get out your shoebox of receipts and let s get organized Our team at Taxko created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 check out this quick video . 2023 Federal Form 1040 Schedule C Profit Or Loss From Business e File, If you have 400 or more of business income over and above your expenses you need to file a Schedule C or C EZ and a Schedule SE to pay self employment tax even if you would not otherwise have enough income to be required to file a tax return pdf and you will need the free Acrobat Reader to view and print the files Schedule C Form .

Free Printable Schedule C Tax Form

2023 Federal Form 1040 Schedule C Profit Or Loss From Business e File

File your Schedule C with the IRS for free Report self employment income and expenses E File schedules for form 1040 and form 1040 SR using FreeTaxUSA All Years 2017 2023 File 2023 Tax Return File 2022 Tax Return File 2021 Tax Return View My Prior Year Return s After You File .

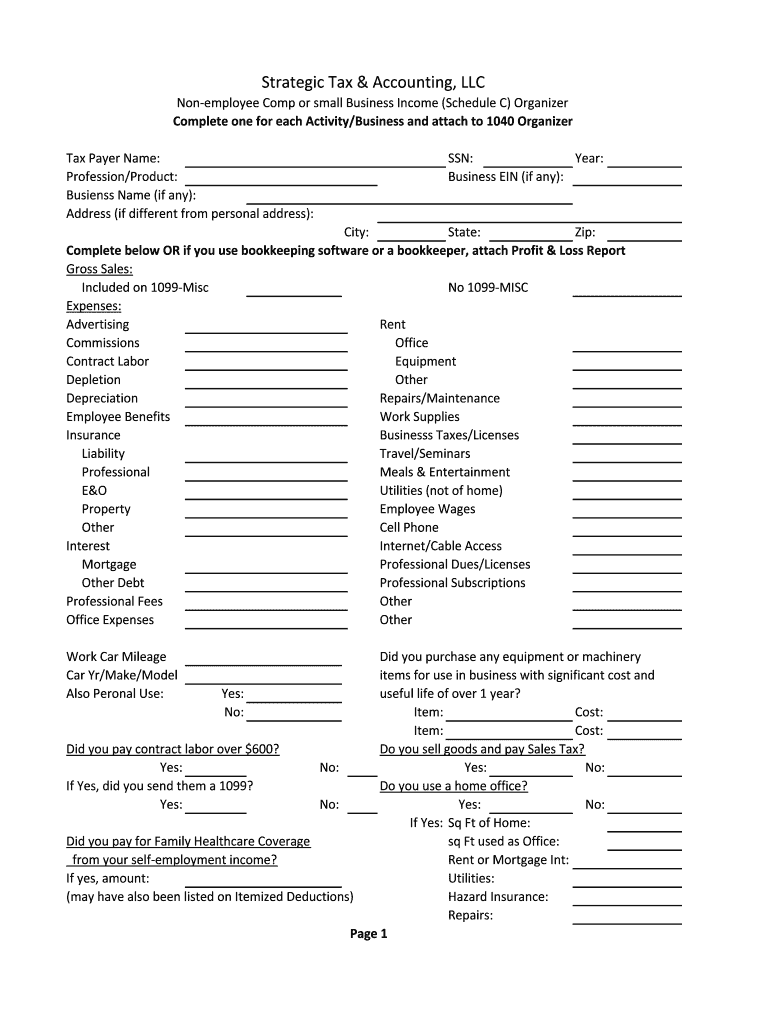

Free Download Schedule C Excel Worksheet for Sole Proprietors and Self

Sole proprietors get out your shoebox of 2022 receipts and let s get organized Our team at Blue Fox created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 this easy to use tool will get your financial ducks in a row We highly recommend using it before you attempt the official IRS form .

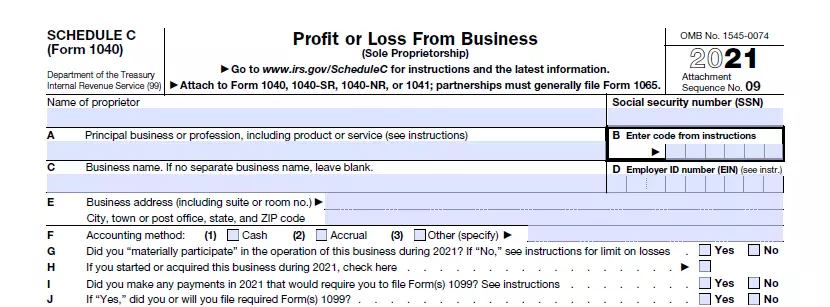

About Schedule C Form 1040 Profit or Loss from Business Sole

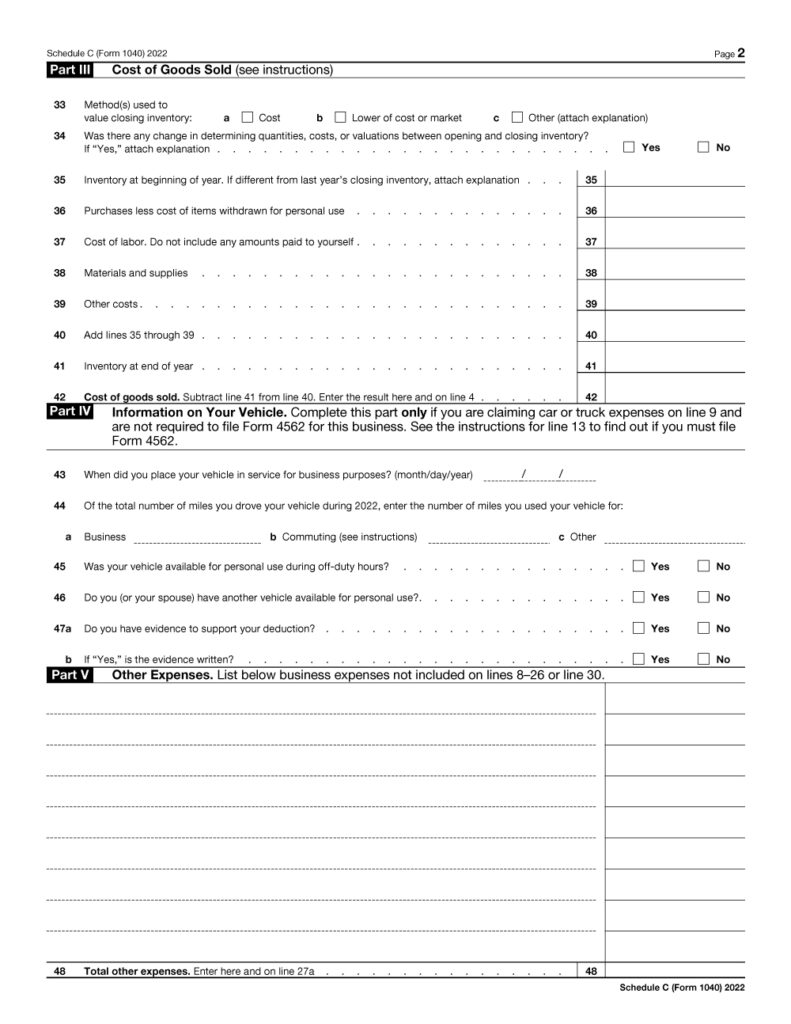

We last updated Federal 1040 Schedule C in January 2025 from the Federal Internal Revenue Service This form is for income earned in tax year 2024 with tax returns due in April 2025 We will update this page with a new version of the form for 2026 as soon as it is made available by the Federal government Other Federal Individual Income Tax .

Free Download Schedule C Excel Worksheet for Sole Proprietors

The Best Way to reduce you taxable income is Track Income Expenses for Tax Form 1040 Schedule C I would love for you the taxpayer to get out your shoebox of receipts and let s get organized Our team at Taxko created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 check out this quick video .

Federal Profit or Loss from Business Sole Proprietorship

How Form 1040 SS filers should report expenses for the business use of their home on Schedule C Form 1040 in 2023 04 JUNE 2024 Changes to the 2023 Instructions for Schedule C Form 1040 09 FEB 2024 Updated references for Publication 535 2023 Instructions for Schedule C Form 1040 23 JAN 2024.

Schedule C Form 1040 Profit or Loss from Business Sole

The 2023 Form 1040 Schedule C is a supplemental form used in conjunction with the Form 1040 to report the profit or loss from a sole proprietorship business This schedule is used by self employed individuals who operate a business as a sole proprietorship including freelancers independent contractors and small business owners .

Disclaimer: Content here is intended for educational and non-commercial purposes only. All trademarks, logos, and brands are the property of their respective owners. For inquiries about rights or usage, feel free to contact us.

![schedule-c-instructions-with-faqs for Free Printable Schedule C Tax Form Schedule C Instructions [with FAQs] for Free Printable Schedule C Tax Form](https://www.thesmbguide.com/images/schedule-c-instructions-1266x960-20181218.png)

Your Questions Answered

1. What are free printables used for?

Free printables are files available for free download and printing, such as activity sheets, planners, and more!

2. Can I find a variety of printables?

Our printables include everything from interactive learning games, coloring sheets, to craft templates.

3. How do I get my free printable?

Click the printable you want, and a new window will appear for you to download it. Right-click to save!

4. Do they print well?

Yes, the printables are in high-resolution formats like PNG and JPG, perfect for clear, crisp printing.

5. Can I use them for business?

These printables are for personal use only, unless the original creator specifies otherwise. For business use, check the licensing terms.