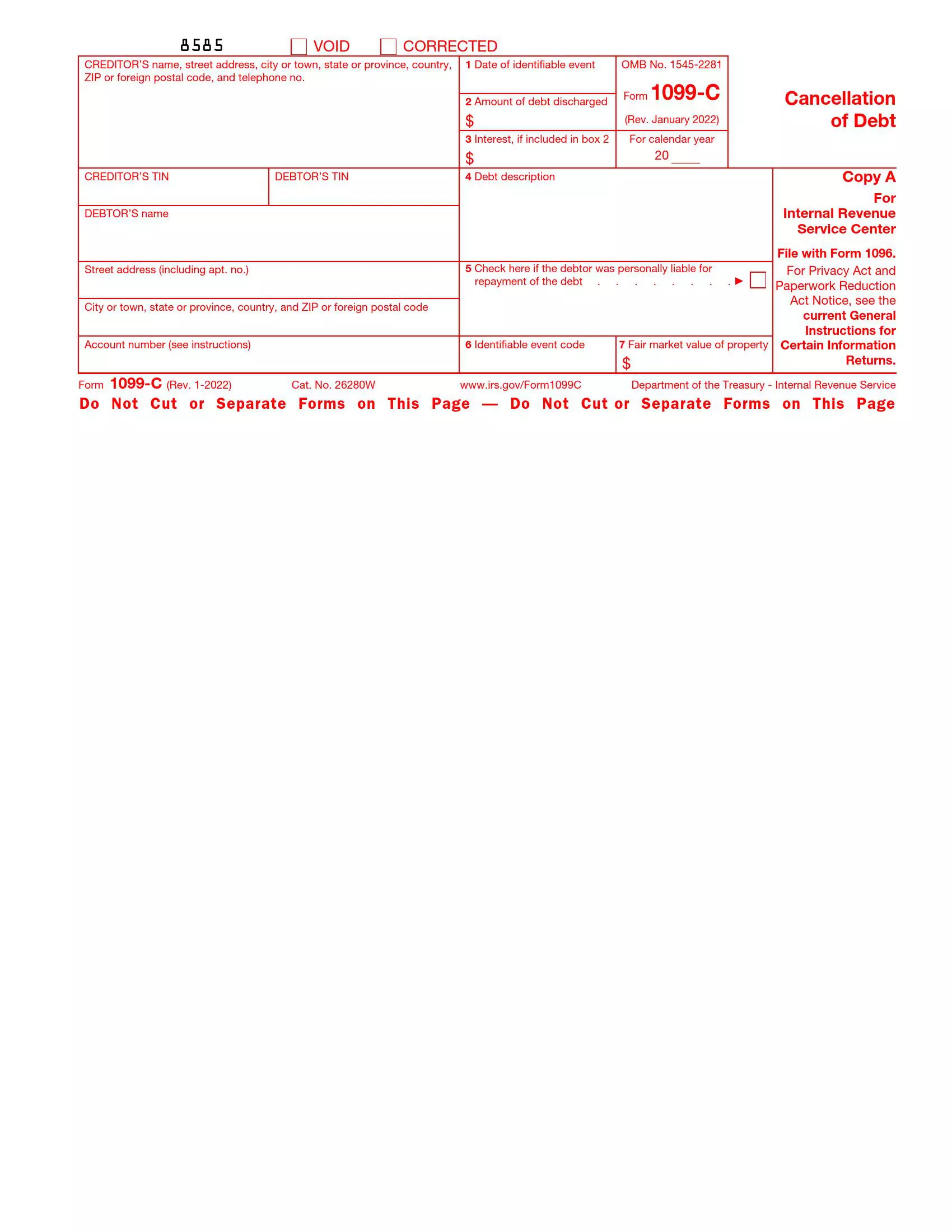

JORDANOVWRESTLING.COM | Free Printable 1099 Template - Access the IRS s full list of miscellaneous income 1099 MISC Exempt from 1099 Corporations Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099 you may file a black and white Copy A that you print from the IRS website with Form 1096 7 How to File 5 Steps

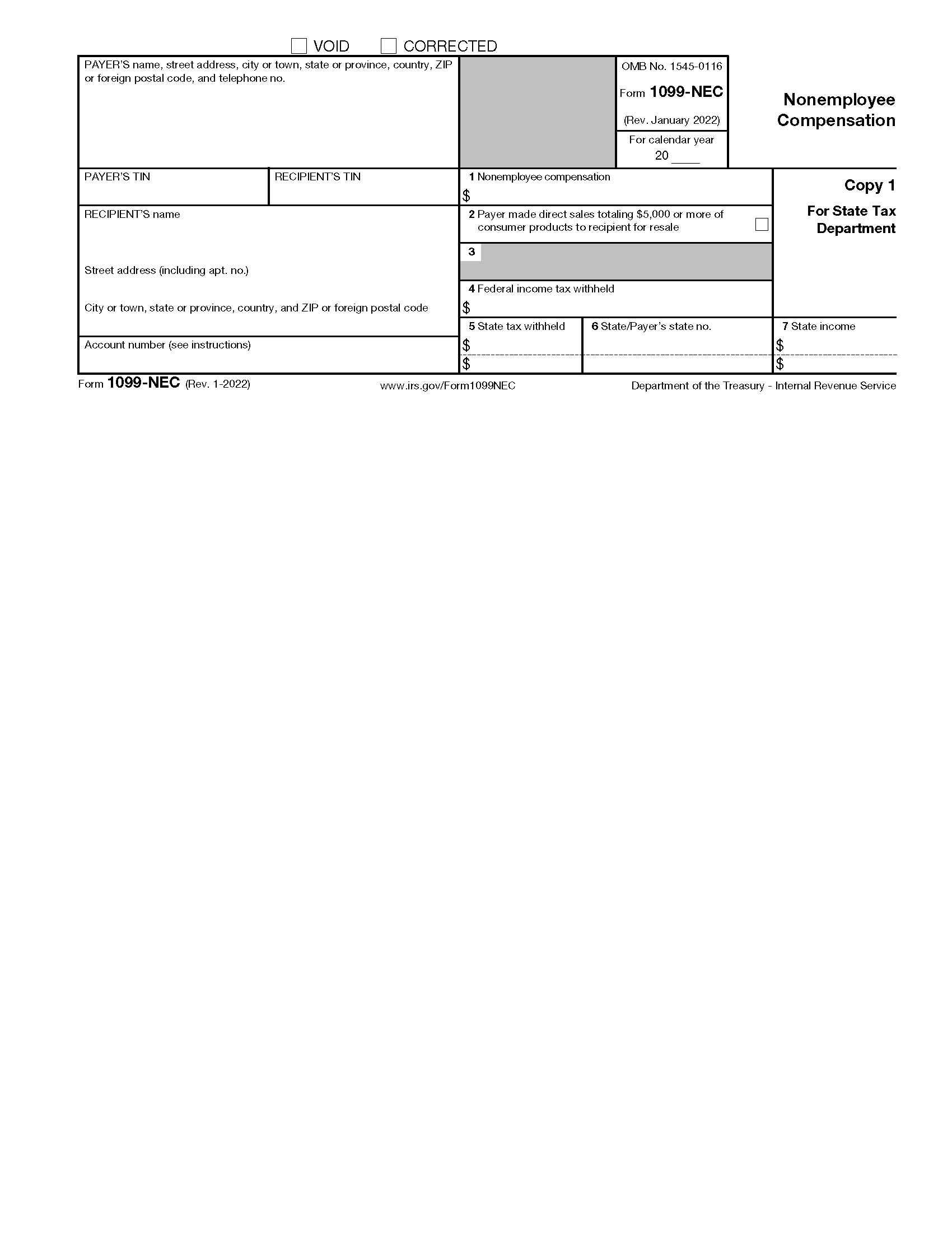

Free IRS 1099 Form PDF eForms, Form 1099 NEC Reports nonemployee compensation Form 1096 Summarizes all information returns a business submits to the IRS Form W 9 Lets a business collect taxpayer identification information from payees Form 1099 K Reports payments made to a business via a credit card processor or another third party network Legal Considerations. Excel Templates To Print Onto Red IRS 1099 Forms, A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately .

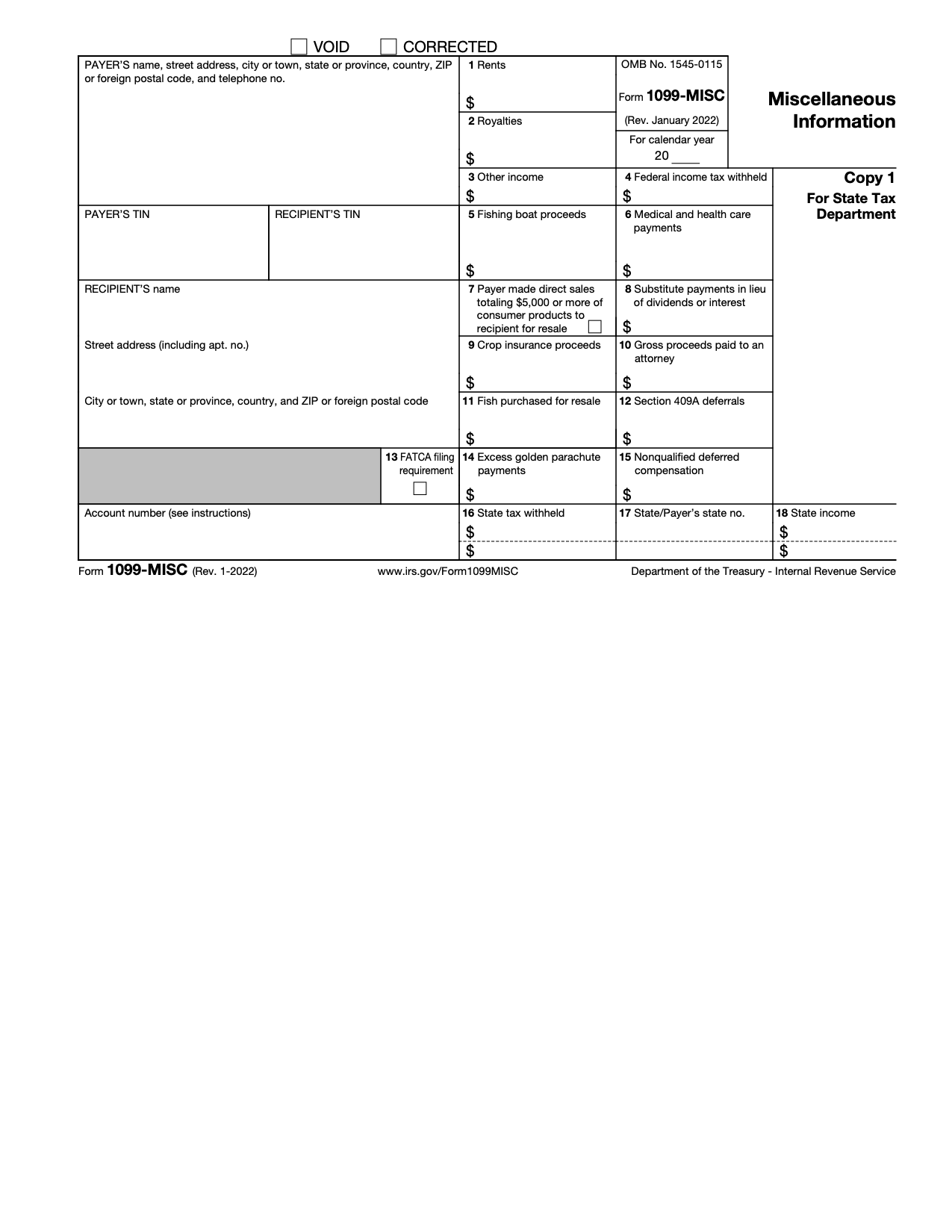

Free Printable 1099 Template

![]()

Excel Templates To Print Onto Red IRS 1099 Forms

Access the IRS s full list of miscellaneous income 1099 MISC Exempt from 1099 Corporations Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099 you may file a black and white Copy A that you print from the IRS website with Form 1096 7 How to File 5 Steps .

2024 IRS Form 1099 MISC Fill Out Save With Our PDF Editor

It s free to use but you ll need to apply for an IRIS Transmitter Control Code TCC Some third party providers also facilitate Form 1099 NEC filings through their software The deadline for filing Form 1099 NEC with the IRS is January 31 2025 for the 2024 tax year You must also provide a copy to your recipient payees by this date .

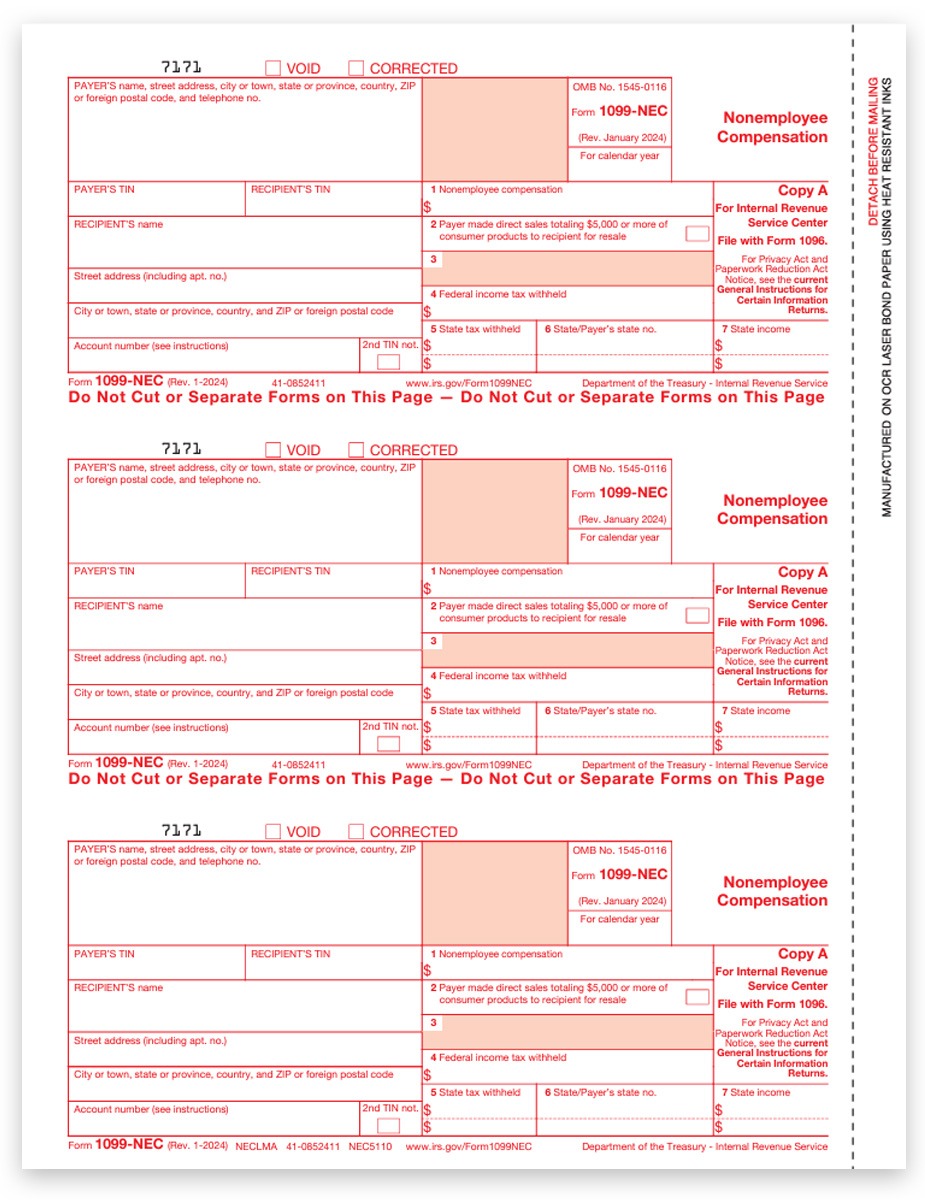

Form 1099 MISC Free Template Dropbox Sign

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes .

2024 IRS Form 1099 NEC Fill Out Save With Our PDF Editor

Form 1099 NEC Reports nonemployee compensation Form 1096 Summarizes all information returns a business submits to the IRS Form W 9 Lets a business collect taxpayer identification information from payees Form 1099 K Reports payments made to a business via a credit card processor or another third party network Legal Considerations.

Free IRS 1099 NEC Form 2021 2024 PDF eForms

An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS .

Free IRS Form 1099 MISC PDF eForms

Download fillable Excel template spreadsheet to easily print onto IRS 1099 form with proper alignment 1099 NEC 1099 MISC 1099 INT 1096 No sign up Easily Align and Print Your 1099 Forms Using Our Excel Customized Templates.

Disclaimer: Content here is intended for educational and non-commercial purposes only. All trademarks, logos, and brands are the property of their respective owners. For inquiries about rights or usage, feel free to contact us.

Quick FAQs

1. How do I get free printables?

Free printables are files available for free download and printing, such as activity sheets, coloring pages, and more!

2. What are the options available for printables?

You'll find planners, learning tools, creative pages, and more in our free printable collection.

3. Can I download it instantly?

Click the image or link to open the printable, and save it to your computer with a right-click. It’s free and easy!

4. Do they print well?

Most printables are in high-quality PNG or JPG formats, ensuring great print quality.

5. Are commercial licenses available?

These printables are for personal use only, unless the original creator specifies otherwise. For business use, check the licensing terms.